What Is California State Tax Withholding Form? Easy Filing

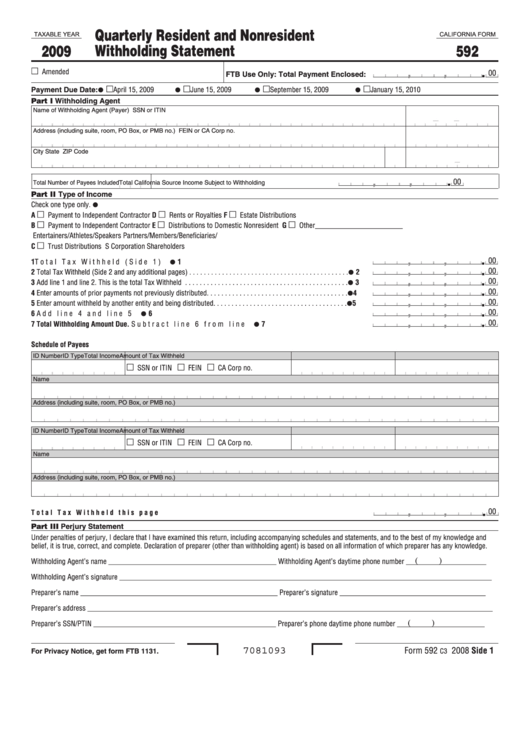

The California state tax withholding form is a crucial document for employers and employees in the state of California. It is used to report the amount of state income tax withheld from an employee's wages and to claim any credits or deductions that may be applicable. The form is typically filed with the California Franchise Tax Board (FTB) on a quarterly or annual basis, depending on the employer's withholding obligations.

Understanding the California State Tax Withholding Form

The California state tax withholding form, also known as the DE 4 form, is used to calculate the amount of state income tax to be withheld from an employee’s wages. The form takes into account the employee’s filing status, number of allowances, and any additional withholding requested by the employee. Employers are required to provide each employee with a copy of the completed form, which must be signed and dated by the employee.

Types of California State Tax Withholding Forms

There are several types of California state tax withholding forms, including:

- DE 4: The standard California state tax withholding form, used for most employees.

- DE 4P: A special form used for pension and annuity withholding.

- DE 4S: A form used for self-employment tax withholding.

Each form has its own specific instructions and requirements, and employers must ensure that they are using the correct form for each employee's situation.

Filing Requirements for California State Tax Withholding Forms

Employers in California are required to file the state tax withholding form with the FTB on a quarterly or annual basis, depending on the amount of withholding. The filing requirements are as follows:

| Withholding Amount | Filing Frequency |

|---|---|

| 700 or more per quarter</td><td>Quarterly</td></tr> <tr><td>70 or more per month, but less than 700 per quarter</td><td>Quarterly</td></tr> <tr><td>Less than 70 per month | Annually |

Employers who fail to file the state tax withholding form on time may be subject to penalties and interest, so it is essential to ensure that the form is filed correctly and on time.

Easy Filing Options for California State Tax Withholding Forms

The California FTB offers several easy filing options for employers, including:

- e-Services: An online filing system that allows employers to file and pay withholding taxes electronically.

- Web Pay: A secure online payment system that allows employers to make withholding tax payments electronically.

- Phone: Employers can file and pay withholding taxes by phone using the FTB’s automated phone system.

These easy filing options can help employers to save time and reduce the risk of errors or penalties.

Importance of Accurate Filing of California State Tax Withholding Forms

Accurate filing of the California state tax withholding form is essential to ensure that employers are in compliance with state tax laws and regulations. Failure to file the form correctly or on time can result in penalties, interest, and other consequences. Employers must ensure that they are using the correct form, following the correct filing procedures, and providing accurate information to the FTB.

Consequences of Inaccurate Filing of California State Tax Withholding Forms

The consequences of inaccurate filing of the California state tax withholding form can be severe, including:

- Penalties: Employers may be subject to penalties for late filing, underpayment, or incorrect filing.

- Interest: Employers may be charged interest on any unpaid withholding taxes.

- Audits: The FTB may conduct an audit to ensure that the employer is in compliance with state tax laws and regulations.

Employers must take the time to ensure that they are filing the California state tax withholding form accurately and on time to avoid these consequences.

What is the purpose of the California state tax withholding form?

+The California state tax withholding form is used to report the amount of state income tax withheld from an employee’s wages and to claim any credits or deductions that may be applicable.

How often must employers file the California state tax withholding form?

+Employers must file the California state tax withholding form on a quarterly or annual basis, depending on the amount of withholding.

What are the consequences of inaccurate filing of the California state tax withholding form?

+The consequences of inaccurate filing of the California state tax withholding form can include penalties, interest, and audits.