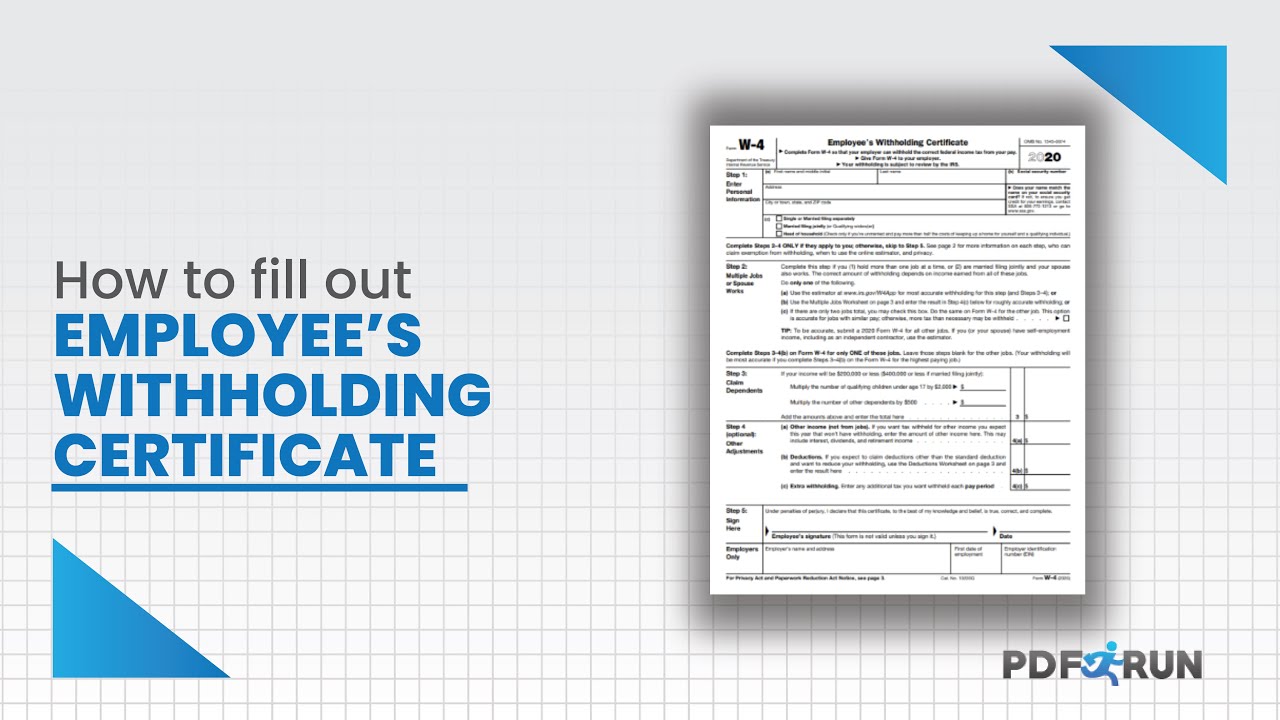

How To Fill California State Tax Withholding Form? Step Guide

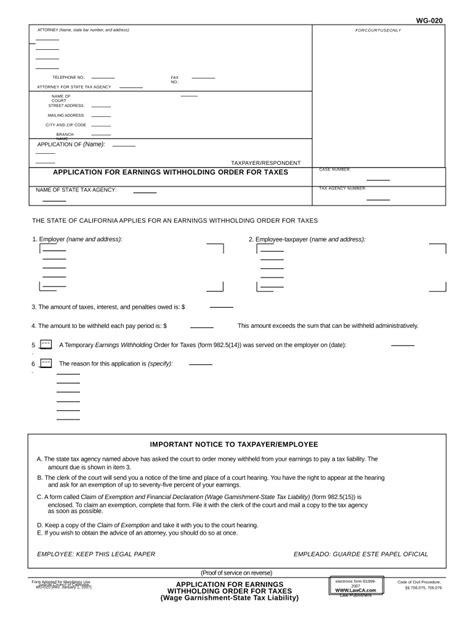

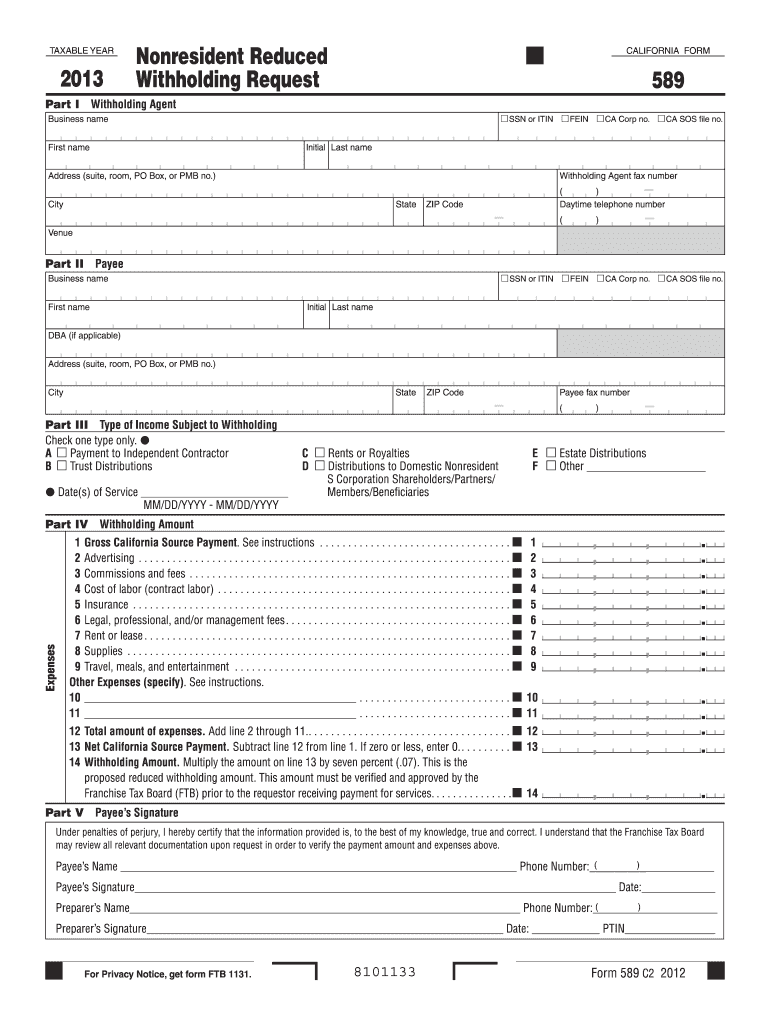

California state tax withholding is a crucial aspect of managing one's finances, especially for those who are employed or have income from various sources within the state. The California State Tax Withholding Form, also known as the DE 4 Form, is used by employees to determine the amount of state income tax that should be withheld from their wages. In this article, we will provide a step-by-step guide on how to fill out the California State Tax Withholding Form.

Introduction to the DE 4 Form

The DE 4 Form is a California state tax withholding form that allows employees to claim the number of allowances they are eligible for, which in turn determines the amount of state income tax withheld from their wages. The form is typically provided by employers to new employees or upon request. It’s essential to fill out the form accurately to avoid any discrepancies in tax withholding.

Who Needs to Fill Out the DE 4 Form?

Any employee who works in California and receives a paycheck is required to fill out the DE 4 Form. This includes:

- Full-time and part-time employees

- Seasonal workers

- Contractors who receive a Form 1099-MISC

It’s also important to note that employees who have a change in their tax situation, such as a change in marital status, number of dependents, or a move to a new home, should update their DE 4 Form to reflect these changes.

Step-by-Step Guide to Filling Out the DE 4 Form

Filling out the DE 4 Form is a straightforward process. Here are the steps to follow:

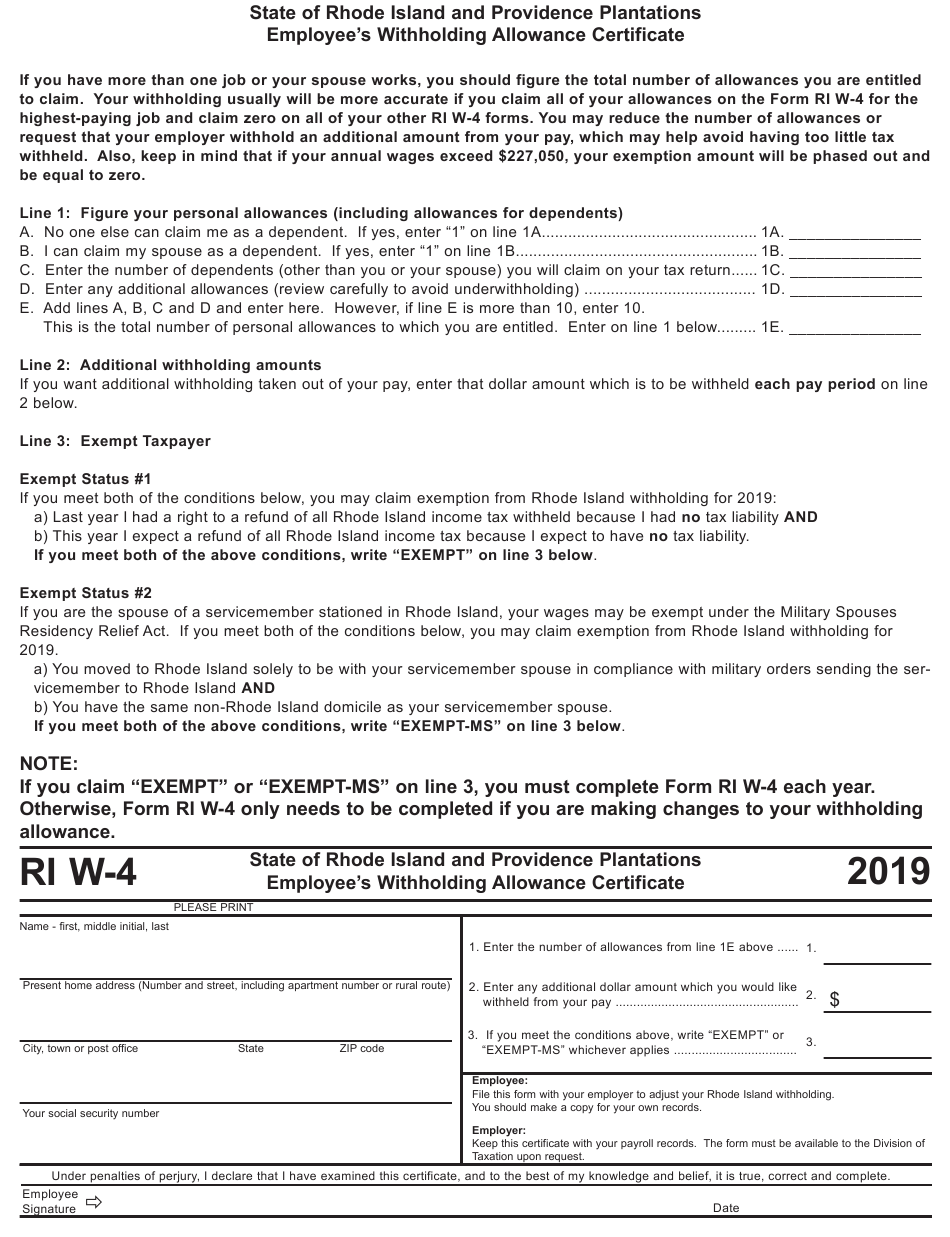

Step 1: Enter Your Personal Information

Start by filling out your personal information, including your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN). Make sure to use your full legal name as it appears on your Social Security card or ITIN documentation.

Step 2: Determine Your Filing Status

Choose your filing status from the options provided. The filing status options are:

- Single

- Married/RDP (Registered Domestic Partner)

- Head of household

- Qualifying widow(er)

Your filing status will determine the number of allowances you are eligible for.

Step 3: Claim Your Allowances

An allowance is an amount of money that is subtracted from your taxable income, reducing the amount of state income tax withheld. You can claim allowances for:

- Yourself

- Your spouse/RDP

- Dependents

- Other eligible individuals

The number of allowances you claim will determine the amount of state income tax withheld from your wages. Be careful not to claim too many allowances, as this could result in under-withholding and a tax bill when you file your state tax return.

Step 4: Claim Additional Allowances (Optional)

If you have additional income or expenses that affect your tax situation, you may be eligible to claim additional allowances. This could include:

- Child care expenses

- Elder care expenses

- Disability expenses

- Other eligible expenses

Be sure to review the instructions carefully to determine if you are eligible to claim additional allowances.

Step 5: Sign and Date the Form

Once you have completed the form, sign and date it. Make sure to use your full legal name and the date you completed the form.

Submitting the DE 4 Form

After completing the DE 4 Form, submit it to your employer’s payroll or human resources department. Your employer will use the information on the form to determine the amount of state income tax to withhold from your wages.

Important Notes

It’s essential to keep in mind that the DE 4 Form is not a tax return, but rather a withholding form. The information you provide on the form will only affect the amount of state income tax withheld from your wages, not your federal income tax withholding.

| Allowance Category | Number of Allowances |

|---|---|

| Single | 1 |

| Married/RDP | 2 |

| Head of household | 2 |

| Qualifying widow(er) | 2 |

Common Mistakes to Avoid

When filling out the DE 4 Form, it’s essential to avoid common mistakes that could result in under-withholding or over-withholding of state income tax. Some common mistakes to avoid include:

- Claiming too many allowances

- Failing to update the form after a change in tax situation

- Not signing and dating the form

- Not submitting the form to the employer’s payroll or human resources department

By avoiding these common mistakes, you can ensure that your state income tax withholding is accurate and avoid any potential tax bills or penalties.

Conclusion

Filling out the California State Tax Withholding Form (DE 4) is a straightforward process that requires careful attention to detail. By following the steps outlined in this guide and avoiding common mistakes, you can ensure that your state income tax withholding is accurate and avoid any potential tax bills or penalties. Remember to review and update your DE 4 Form regularly to reflect any changes in your tax situation.

What is the purpose of the DE 4 Form?

+

The DE 4 Form is used to determine the amount of state income tax that should be withheld from an employee’s wages.

Who is required to fill out the DE 4 Form?

+

Any employee who works in California and receives a paycheck is required to fill out the DE 4 Form.

How often should I update my DE 4 Form?

+

You should update your DE 4 Form whenever you have a change in your tax situation, such as a change in marital status, number of dependents, or a move to a new home.