Exit Tax California

The concept of an exit tax in California has garnered significant attention in recent years, particularly among high-net-worth individuals and businesses considering relocating out of the state. An exit tax, in the context of California, refers to the state's attempt to tax the unrealized gains of assets when a resident leaves the state. This mechanism is designed to ensure that California captures the tax revenue it would have received if the individual or business had remained in the state and eventually sold the assets while still a resident.

Understanding California’s Exit Tax

California’s exit tax is essentially a part of the state’s broader taxation strategy aimed at maintaining its revenue base. By taxing the gains from the sale of assets, even if those sales occur after the taxpayer has left the state, California seeks to prevent a potential loss of tax revenue. The tax applies to certain residents who leave California and have assets that would trigger a significant capital gains tax if sold. This includes stocks, bonds, real estate, and businesses.

How the Exit Tax Works

The exit tax is calculated based on the unrealized gains of the assets at the time the individual or business leaves California. The idea is that if these assets were sold, the gains would be subject to capital gains tax. However, instead of waiting for the sale to occur, California imposes an immediate tax liability on the unrealized gains. This tax can be deferred until the assets are actually sold, but the taxpayer must file specific paperwork with the state to arrange for this deferral.

The process involves filing Form 540 with the California Franchise Tax Board (FTB) for the tax year the taxpayer leaves California. The form requires detailed information about the assets, their basis (original cost), and their fair market value at the time of departure. This information is used to calculate the unrealized gains and, consequently, the exit tax owed.

| Asset Type | Unrealized Gain | Exit Tax Rate |

|---|---|---|

| Stocks | 10% of fair market value | 13.3% (top marginal rate) |

| Real Estate | 10% of fair market value | 13.3% (top marginal rate) |

| Business Interests | 10% of fair market value | 13.3% (top marginal rate) |

Exemptions and Mitigation Strategies

Not all individuals or businesses leaving California are subject to the exit tax. Certain exemptions apply, such as for those with limited assets or those who are leaving the state for specific reasons like military service. Additionally, taxpayers can mitigate the impact of the exit tax by structuring their assets in a way that minimizes unrealized gains at the time of departure. This might involve selling assets before leaving California or using tax-deferred exchanges for real estate and other qualified assets.

For those who are subject to the exit tax, deferring the payment until the assets are sold can provide a cash flow benefit, although it does not eliminate the tax liability. It's also worth noting that the exit tax is a state tax issue, and federal tax laws may interact with California's exit tax in complex ways, potentially affecting the overall tax burden.

Future Implications and Considerations

The exit tax is a significant consideration for anyone contemplating a move out of California. As the state continues to evolve its tax policies, it’s possible that the exit tax could become more stringent or that new exemptions could be introduced. Taxpayers must stay informed about these developments and plan accordingly. The use of tax planning strategies, such as gifting assets to family members or charities, or utilizing trusts, can also be effective in reducing the exit tax liability.

In conclusion, California's exit tax is a complex and nuanced aspect of the state's tax code, designed to capture tax revenue that might otherwise be lost when residents relocate. Understanding how the exit tax works, including its calculation, exemptions, and mitigation strategies, is essential for individuals and businesses considering a move out of California.

What is the purpose of California’s exit tax?

+The purpose of California’s exit tax is to ensure that the state captures tax revenue from the unrealized gains of assets when a resident leaves the state, preventing a potential loss of tax revenue.

How is the exit tax calculated in California?

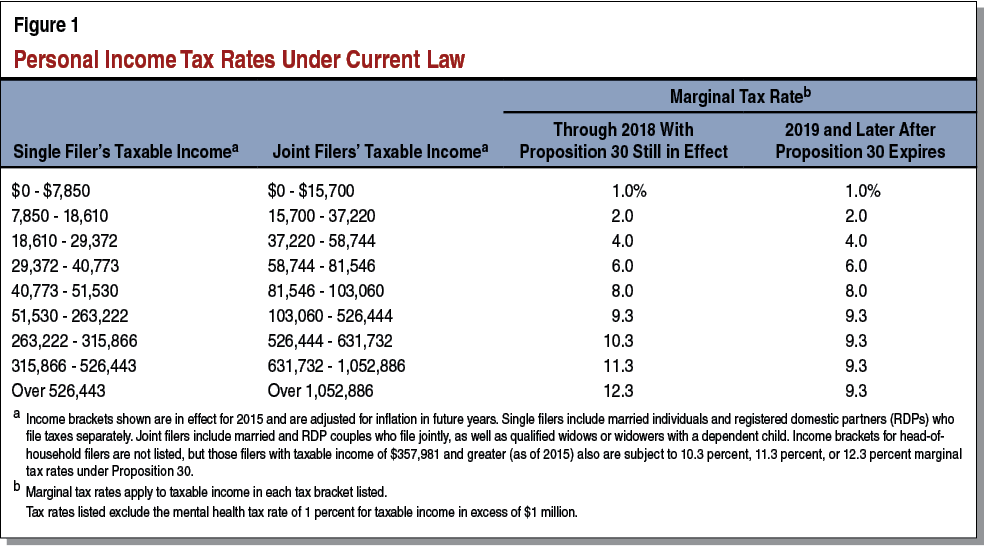

+The exit tax is calculated based on the unrealized gains of assets at the time the individual or business leaves California, using the fair market value of the assets and applying the top marginal tax rate of 13.3%.