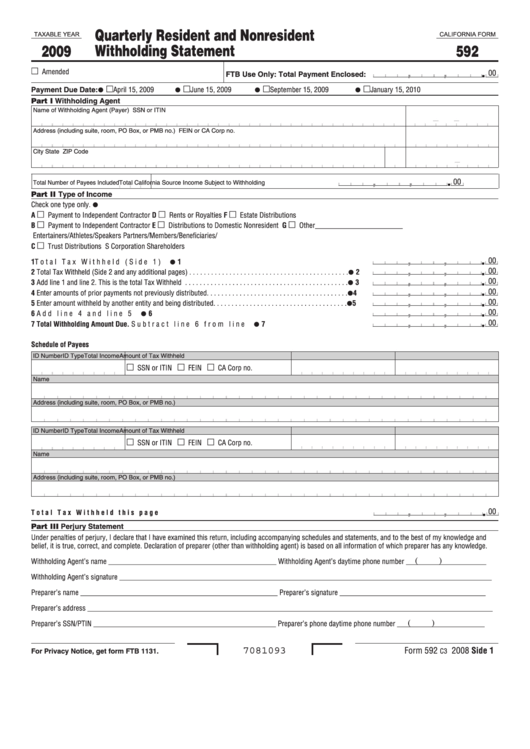

California State Tax Withholding Form

The California state tax withholding form is a crucial document for employers and employees alike, as it ensures that the correct amount of state income tax is withheld from an employee's wages. The form, also known as the DE 4, is used to determine the amount of California state income tax to be withheld from an employee's paycheck.

Understanding the California State Tax Withholding Form

The DE 4 form is used by employers to determine the correct amount of state income tax to withhold from an employee’s wages. The form takes into account the employee’s filing status, number of allowances, and other factors to determine the correct withholding amount. Employers are required to provide employees with a DE 4 form when they start a new job, and employees must complete and return the form to their employer.

Components of the California State Tax Withholding Form

The DE 4 form includes several components that are used to determine the correct amount of state income tax to withhold. These components include:

- Filing Status: The employee’s filing status, such as single, married, or head of household, which affects the amount of tax withheld.

- Number of Allowances: The number of allowances the employee claims, which reduces the amount of tax withheld.

- Additional Withholding: The employee may request additional withholding, which increases the amount of tax withheld.

- Exemptions: The employee may claim exemptions, such as blindness or disability, which reduces the amount of tax withheld.

Employers use the information provided on the DE 4 form to determine the correct amount of state income tax to withhold from an employee's wages. The form is typically completed by the employee and returned to the employer, who then uses the information to update the employee's tax withholding.

| Form Component | Description |

|---|---|

| Filing Status | The employee's filing status, such as single or married. |

| Number of Allowances | The number of allowances the employee claims. |

| Additional Withholding | The employee's request for additional withholding. |

| Exemptions | The employee's claimed exemptions, such as blindness or disability. |

California State Tax Withholding Rates

California state income tax withholding rates range from 1% to 13.3%, depending on the employee’s income level and filing status. The rates are as follows:

- 1% to 8%: For single filers with incomes up to 53,099 and joint filers with incomes up to 106,198.

- 9.3% to 10.3%: For single filers with incomes between 53,100 and 266,745 and joint filers with incomes between 106,199 and 533,491.

- 11.3% to 12.3%: For single filers with incomes between 266,746 and 322,499 and joint filers with incomes between 533,492 and 644,997.

- 13.3%: For single filers with incomes over 322,499 and joint filers with incomes over 644,997.

Employers must use these rates to determine the correct amount of state income tax to withhold from an employee's wages, based on the information provided on the DE 4 form.

California State Tax Withholding Exemptions

California state income tax withholding exemptions include:

- Blindness or Disability: Employees who are blind or have a disability may be eligible for an exemption.

- Dependent Exemptions: Employees may claim exemptions for dependents, such as children or elderly parents.

- Other Exemptions: Employees may be eligible for other exemptions, such as exemptions for military personnel or individuals with certain medical conditions.

What is the purpose of the California state tax withholding form?

+The purpose of the California state tax withholding form, also known as the DE 4, is to determine the correct amount of state income tax to withhold from an employee’s wages.

How do I complete the California state tax withholding form?

+To complete the California state tax withholding form, employees should provide their filing status, number of allowances, and other relevant information. Employers will use this information to determine the correct amount of state income tax to withhold.

What are the California state tax withholding rates?

+California state income tax withholding rates range from 1% to 13.3%, depending on the employee’s income level and filing status. The rates are as follows: 1% to 8% for single filers with incomes up to 53,099 and joint filers with incomes up to 106,198, 9.3% to 10.3% for single filers with incomes between 53,100 and 266,745 and joint filers with incomes between 106,199 and 533,491, 11.3% to 12.3% for single filers with incomes between 266,746 and 322,499 and joint filers with incomes between 533,492 and 644,997, and 13.3% for single filers with incomes over 322,499 and joint filers with incomes over 644,997.